Propedge Trading – Mastering the Orderbook Download

About Course

Short Description

Propedge Trading’s Mastering the Orderbook is a 4-week webinar series teaching institutional-level order flow reading, liquidity imbalances, and execution strategies for consistent profitability in volatile equity futures markets.

Here’s What You Get

-

4 weeks of recorded webinars with live DOM analysis.

-

Real-time trade examples and A+ setup breakdowns.

-

PDFs, checklists for orderbook patterns and risk rules.

-

Focus on FESX/DAX with practical execution templates.

Course Structure

Weekly webinar progression: DOM foundations → liquidity imbalances → advanced setups → trade management and scaling, with real-market demonstrations.

Who Should Enroll

Futures traders seeking precision over indicators, especially those trading European indices who want systematic DOM edge for scalping and day trading.

Benefits of Participating

Achieve trading consistency by reading real-time order flow, spot liquidity traps, and execute with 60-90% accuracy for reliable tick profits.

Course Overview

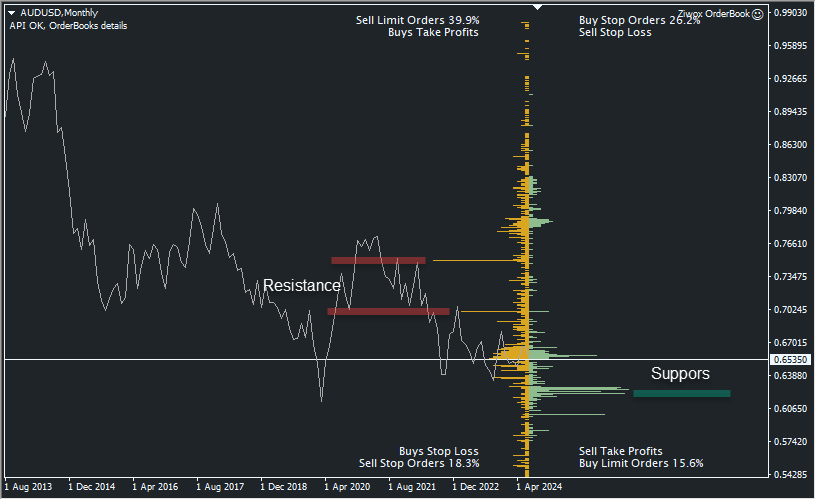

In-depth training on orderbook dynamics showing how institutions manipulate retail, with strategies to align with smart money for high-probability entries.

What Is It For

Building a repeatable DOM trading system that delivers consistent winners through market depth analysis rather than price action alone.

Course Highlights

-

Liquidity gap identification for explosive moves.

-

Bid/ask imbalance reading for directional bias.

-

10-20 tick A+ setups in FESX/DAX.

-

Risk management for scalping consistency.

Course Content

Week 1: DOM Foundations & Orderbook Basics (4 hours)

-

Session 1: Understanding Market Depth & Bid/Ask Dynamics (1h 30m)

-

Session 2: Liquidity Concepts & Imbalance Signals (1h 30m)

-

Session 3: Platform Setup & Basic Reading (1h)

Week 2: Liquidity Analysis & Patterns (4 hours)

Week 3: High-Probability Setups (4 hours)

Week 4: Execution & Management (4 hours)

Get Full Course Package

Student Ratings & Reviews